About 56 percent showed supply expenses, and 53 percent took deductions for utilities.

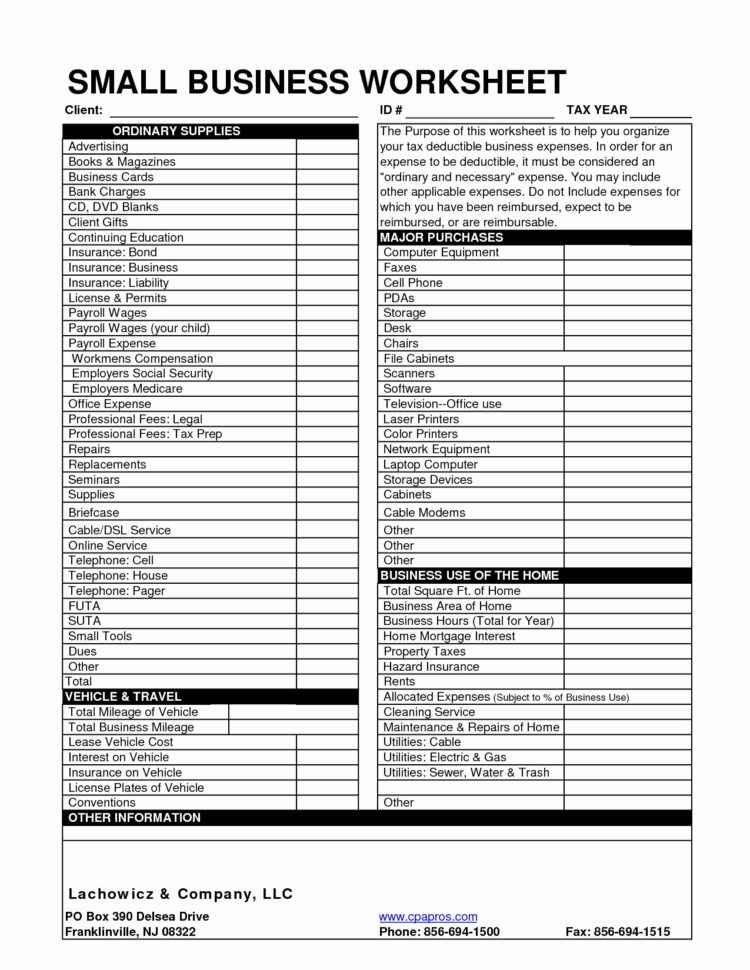

(See chart at right.)Įxample: Car and truck expenses were the most frequently claimed Schedule C expense, appearing on 71 percent of Schedule C’s, making up about 11 percent of the total dollar amount of expenses claimed. Plus, the study lists each expense as a percentage of the total Schedule C expenses. If you do business as a sole proprietorship or single-member LLC, check out a newly published Government Accounting Office (GAO) report listing the percentage of taxpayers who claim each type of expense on Schedule C. That’s why it’s good to know whether your deductions fall within the national averages. Ready to get started? Just sign up or log in as soon as you get your Forms 1099-NEC, and we’ll guide you through the process.You never want your tax return to stick out like a sore thumb at the IRS. Plus, you’ll get our flat $25 rate-a great deal for anyone filing a Schedule C, since that could bump you up to the priciest tiers on other tax-filing websites! Once you get your copy in the mail or online, it will look something like this:Ĭan I file freelance, independent contractor and self-employment taxes with ?Ībsolutely! We’ve designed our tax-filing walkthrough to be smart, simple, and straightforward for everyone, including those who work independently. What does Form 1099-NEC look like?įorm 1099-NEC is pretty straightforward. When you file your taxes with, we’ll help you complete all the necessary forms to report your freelance income. You’ll also file Schedule SE, Self-Employment Tax, to pay your Social Security and Medicare taxes. Yes-your Form 1099-NEC will provide info that you’ll need to add to your Schedule C, which is where you report income and expense details for your business. Do I still have to fill out other freelance and self-employed forms like a Schedule C and Schedule SE if I get Form 1099-NEC? That means you might even get more than one. Not necessarily-if you earned more than $600 from a client over the course of the year, that client is required to send you a 1099-NEC. Do all freelancers or independent contractors get Form 1099-NEC? That form was starting to get crowded with items like business payments for rent, prizes and awards, medical and health care, and more, so now the two are separate.įorm 1099-NEC serves a similar purpose as a W2 instead of being a form you fill out and file, it provides income information from your work that you’ll need to report on your tax return.

The new Form 1099-NEC is what your nonemployee compensation (aka pay that doesn’t come from an employer) from each client will be reported on instead of Form 1099-MISC. If you’re a freelancer, independent contractor, or self-employed person who is used to getting Form 1099-MISC every year from clients, heads up! This year’s paperwork is going to look a little different, so today we’re introducing Form 1099-NEC.

0 kommentar(er)

0 kommentar(er)